If you are thinking of restructuring your business operations under a different legal structure in order to gain tax, compliance, asset protection, or other commercial benefits then you need to be mindful of any capital gains, stamp duty, or other tax amount that could be triggered. Read on...

Choosing your preferred business structure

There are numerous issues to consider when deciding on an appropriate structure for your business operations, which is why it usually makes sense to seek guidance and advice from an experienced accountant or other professional advisor.

The key issues which will impact your decision include:

- Will you be seeking outside investors and if so what type of investors are they likely to be?

- Do you wish to protect valuable assets (such as intellectual property) from claims against the operating business risks?

- What type of assets will the business hold?

- Will you be employing people?

- Do you wish to protect non-business assets and accumulated profits?

- What taxation benefits do you wish to access?

- What level of costs and/or simplicity do you prefer?

- What level of ongoing compliance and administration do you prefer?

- How much flexibility do you require?

Each of these factors should be considered before determining the most appropriate structure to be used for your business – as the cost of restructuring a mature business can be burdensome.

Of course the above assessment requires you to anticipate how successful the business may become and whether you are likely to bring in new investors or sell your business further down the line.

If you are already in business, then it makes sense to periodically revisit these questions and determine whether your circumstances have changed such that your current structure is no longer appropriate.

Why might a business look to restructure?

There are many reasons for restructuring your business and these could broadly include:

- Change in management - You may be taking on a business partner, so you decide to change from a sole trader to a partnership structure.

- Change in ownership - If you buy an existing business, you may decide to change the business structure to meet your goals for the business.

- Financial reasons - You may be restructuring to meet financial goals and objectives, such as improving cash flow or profitability of the business.

- Operational reasons - You may be reorganising your internal functions, such as sales and marketing, to improve the way your business operates.

- Business growth - Your business may have expanded overseas or you're expanding the product functions of the business and you need to change your structure to accommodate this growth.

- Economic downturn or downsizing - You may want to downsize or simplify your business structure, e.g. moving from a company to sole trader.

In recent years there has been a move towards using companies as the primary vehicle to operate businesses under. If your business is currently structured as a sole trader, partnership or trust you may no longer consider that appropriate for a number of reasons including:

- The structure may not provide sufficient asset protection for things like IP, real estate, or plant and equipment.

- You may wish to separate non-business assets from trading activities

- You may wish to separate the business into two separate trading entities

- You may be looking to bring investors into the business

- You may want or be required to operate under a more commercial structure for a potential customer or supplier

- You may be trying to attract key employees and retain them through stock options or succession planning.

- You may be trying to access some taxation benefits

Each business structure has different legal and compliance obligations, so make sure you understand the differences before changing your business structure. The answer is not easy and there are many more complex issues at hand. It may also be a case that a combination of trust and company structure can be optimised to provide you with a wider range of benefits.

As mentioned, this is why it almost always makes sense to seek guidance and advice from an experienced accountant or other professional advisor.

Establish a Family Trust | Establish a Unit Trust | Establish a SMSF | Establish a Company

Issues to consider before restructuring

Prior to restructuring there are a number of other issues which need to be understood such as:

- What are you trying to achieve?

- What are the income tax, GST and duty issues relating to the transfer of assets? Is there relief available?

- What is the impact on commercial arrangements with lenders, customers, suppliers, employees, and other arrangements?

- Does the restructure impact any estate planning issues?

- What are the legal and professional costs involved in restructuring?

For businesses looking to restructure towards a corporate structure there are a number of tax roll-over provisions available which may provide relief on CGT and other tax duties. These include:

- Subdivision 122-A (individual or trustee to a company);

- Subdivision 122-B (partnership to a company);

- Subdivision 124-N (unit trust to a company);

- Inserting a holding company between shareholders and another company using Division 615;

- Subdivision 328-G (small business restructure roll-over).

- Use of the small business CGT concessions

In this article we briefly provide an overview of two of the above tax roll-over provisions.

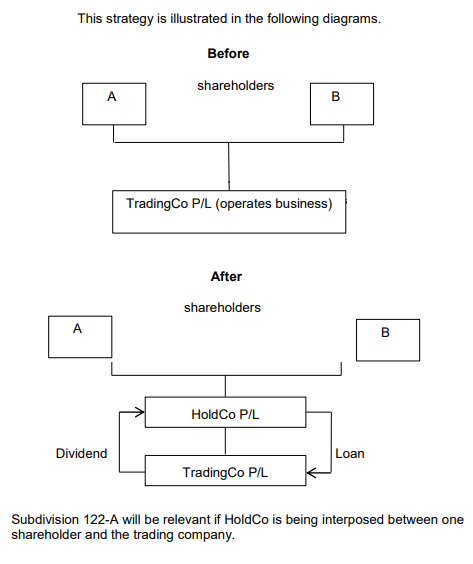

Inserting a holding company between shareholders and another company using Division 615

If you are already operating under a company structure and wish to interpose a holding company structure for the benefits of asset protection or some other commercial benefit, then it is possible to do so without triggering a capital gains event by utilising the capital gains tax rollover relief available under subdivision 122-A, subdivision 122-B, or Division 615 of the 1997 Tax Act.

The strategy of interposing a holding company and declaring dividends from the trading company to the holding company usually provides asset protection benefits for the group, as the holding company can build up assets (such as cash and IP) whilst the trading company contains the risks associated with operating the business.

The main requirement of this restructure (to avoid triggering a CGT event) is that the holding company must own 100% of the shares in the trading company, and the percentage of the shares in the holding company that were issued to the existing shareholders must be the same as the percentage of the shares in the original company. i.e. the beneficial ownership of the structure must not change in any proportion.

There are some other requirements outlined within Division 615 of the 1997 Tax Act.

However the overall outcome if executed correctly is that the original shareholders disregard any capital gain on the transfer of shares and the cost base of the shares will not change.

Subdivision 328-G (small business restructure roll-over)

From 1 July 2016 many small business clients have been able to access an extra form of tax relief when restructuring their business operations. This relief has been designed to provide more flexibility for small businesses to change their legal structure (ie company, trust, partnership, sole trade, etc) without attracting a tax liability at that time.

There are however several strict conditions that need to be met to ensure that the rules can apply.

So how does it work?

If you are operating your business in an entity structure (i.e. company, trust, sole trader) and feel that it no longer suitable for your needs, the new Rollover provides an opportunity to transfer the business to a new entity structure without incurring the tax costs that would normally arise when a business is transferred. The Rollover is available for a broad range of assets considered “active assets” and requires “ultimate economic ownership” of the business to be maintained.

To determine if you can access the Rollover a number of threshold questions need to be resolved:

Question 1: Are the transferor and transferee small businesses?

The Rollover applies to small businesses only, that is, businesses with an aggregated turnover of less than $2million. To determine the aggregated turnover of a business the taxpayer not only has to consider its own business turnover but also the business turnover of other entities that may be affiliated or connected entities.

Question 2: Will ultimate economic ownership of the business be maintained?

The Rollover requires that there is no change in the “ultimate economic ownership” of the business. This requires the proportionate ownership (direct and indirect) in the transferor and transferee to be the same, or, in the case of discretionary trusts, for ownership by members of the same family group to be maintained.

Question 3: Is the restructure a “genuine restructure”?

The legislation and the Legislative Companion Guidelines LCG 2016/3 provide details of the attributes of a “genuine restructure” of an ongoing business and how the Australian Taxation Office (ATO) interpret the term.

As indicated by the inclusion of the requirement for a “genuine restructure” and the safe harbour provisions, this Rollover is expected to apply in circumstances where a small business is being operated from the “wrong” structure and seeks to roll into the “correct” one.

Question 4: What assets are to be transferred as part of the Rollover?

The Rollover applies to gains and losses arising from the transfer of “active assets” including CGT assets, trading stock, revenue assets, depreciating assets and membership interests (e.g. shares or units in a company or trust). It is intended that no income tax consequences arise from the transfer of the respective assets.

While on the face of it this Rollover may be attractive to many small businesses, it requires further investigation into the purpose of a restructure, the assets involved, the associated entities and various other considerations before hitting the “start” button.

More information is available on the ATOs website here:

https://www.ato.gov.au/General/Capital-gains-tax/Small-business-CGT-concessions/Small-business-rollover/

So you want to restructure your business?

As mentioned always speak to your accountant, lawyer or adviser to find out whether your restructure is the right thing for you and your business. Whilst it can appear daunting and complex, the experience of seasoned professionals will allow you to navigate these decisions efficiently and with confidence. The initial professional costs involved will more than save you from unecessary costs down the line.

ABN Australia is able to provide affordable legal documents for all types of business structures including companies, family trusts, unit trusts, and even self managed superannuation funds.

Establish a Family Trust | Establish a Unit Trust | Establish a SMSF | Establish a Company

An Important Message

While every effort has been made to provide valuable, useful information in this publication, this firm and any related suppliers or associated companies accept no responsibility or any form of liability from reliance upon or use of its contents. Any suggestions should be considered carefully within your own particular circumstances, as they are intended as general information only.

Phone 1300 226 226 to discuss how we can help.

Please note this article is for information purposes only and does not constitute legal advice. Should you have any queries or require more information, please contact the team at ABNAustralia.com.au.